With their newly minted majority in both chambers of Congress and the White House, Republicans have just one or two opportunities to pass sweeping legislation without having to negotiate with Democrats. And one of them is making headlines: budget reconciliation. This technical and seemingly obscure congressional mechanism doesn’t come around often, but when it does, it’s the biggest thing on Capitol Hill.

Republicans are expected to use reconciliation to progress their agenda, including rescinding funding for Democrat-passed priorities like climate infrastructure spending in the Inflation Reduction Act (IRA). Where are we at and what’s on the table? What does “Byrdable” mean? And how does this process actually work? Read on!

Budget Reconciliation 101

Budget reconciliation is a special legislative process that allows for speedy (or at least speedier) consideration of certain tax, spending, and debt-limit policies.

One of its key benefits is the ability to avoid the Senate filibuster, meaning a budget reconciliation bill only requires a simple majority (51 votes) in the Senate to pass, rather than the typical 60 votes. Budget reconciliation debate is also limited to 20 hours. Because of these factors, the process is most commonly used when one party controls the White House and both chambers of Congress, but lacks the 60-vote majority in the Senate needed to overcome a filibuster.

Budget reconciliation can only be done once per year—if it’s done at all. Congress has only enacted 23 reconciliation bills since the mechanism became an option in the 1970s. In recent years, it’s been used to amend the Affordable Care Act and modify the federal student loan program (2010), enact tax changes (2017), add additional COVID-19 relief funding (2021), and pass the IRA (2022), which included billions of dollars for ocean and coastal efforts.

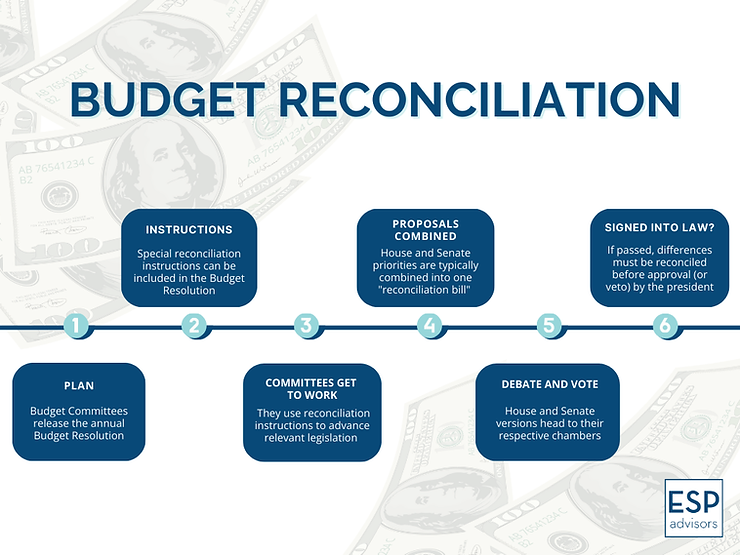

Here’s a simplified breakdown of how it works:

Create a Budget Plan

- It all kicks off when the House and Senate Budget Committees release the annual Budget Resolution, which is developed based on baseline budget projections prepared by the Congressional Budget Office. The Budget Resolution isn’t legally binding (it’s not presented to the president for signature and does not become law), but it serves as a blueprint for fiscal decision-making and hints to a Congress’ fiscal priorities.

- Every year, resolution writers have the option of including special reconciliation instructions as part of this step. If they opt to include them, budget reconciliation is on the table once the resolution is passed by both chambers.

Committees Get to Work

- These instructions direct specific congressional committees to develop and advance legislation to achieve budgetary goals (e.g., reducing the deficit by a certain amount).

Combine the Proposals

- Once committees finish their work, all of their proposals are typically combined into one “reconciliation bill.”

Debate and Vote

- The House and Senate versions of the reconciliation bill head to their respective chambers for floor votes.

- If passed, differences between them must be reconciled before the bill can be signed into law (or vetoed) by the president.

It’s worth noting that there are some limits to what can be included in a budget reconciliation bill. Because of what’s known as the Byrd Rule—which only applies in the Senate—provisions can’t make changes to social security or increase the federal deficit beyond the budget resolutions specified timeframe (usually 10 years). And policies unrelated to the budget can’t—in theory—be tacked on. This is where loopholes come in. For example, a provision related to something like immigration, or climate infrastructure spending in the case of the IRA, can be considered “Byrdable” if the argument can be made that adjusting spending is its primary purpose.

These restrictions have stymied both parties at times, and battles over what’s included tend to involve a lengthy push-pull. The nonpartisan Senate parliamentarian—who advises on interpretation of congressional rules—is among the congressional experts tasked with the budget reconciliation review process. While lawmakers technically can ignore judgements from these experts, new Senate Majority Leader John Thune (R-SD) has already publicly advised Republicans not to do so.

What’s in Play This Year?

Republicans want to move quickly on passing reconciliation, and intraparty negotiations around what should be included are underway. Expect to hear a lot about it in the first few weeks and months of the 119th Congress. Among the most contentious topics related to this year’s reconciliation process is whether or not to proceed with one, large reconciliation package versus splitting the fiscal agenda into two smaller bills. We’re already seeing disagreement within the Republican party over which way to lean.

In a closed-door meeting on January 8, President-Elect Donald Trump sided with Speaker Mike Johnson’s proposal for a one-bill process, despite opposition from some Republican senators. Following the meeting, Senator Ted Cruz (R-TX) told reporters he worries this tactic would be akin to “putting all the eggs in one basket” and that it would risk not getting enough votes. Thune, who shares concerns about a one-bill plan, reportedly asked Trump if he would consider two bills if the party were to run into political roadblocks. Trump has since stated he is open to the idea.

Strategic disputes like this are likely to continue, as are disagreements over what’s ultimately included in the bill(s). Trump has repeatedly made nods to including controversial tariffs in his “big, beautiful, bill,” and there is major disagreement within the Republican party about whether or not to include an adjustment to the federal debt limit. Hardline conservatives are likely to push back on a debt limit adjustment. Any agreed upon change to the debt limit is likely to come alongside demands for significant spending cuts elsewhere in the federal budget, which may prove difficult for other Republicans to swallow. As we’ve seen from the Republican House majority over the past two years, convincing the slim majority to vote together is a significant hurdle.

TL;DR: Whether we see one or two, Republicans’ budget reconciliation bills are likely to extend the party’s 2017 tax cuts. And to pay for any addition to the federal deficit, they’ll be looking for cuts elsewhere—including portions of the Inflation Reduction Act. This, and other partisan budget-related policy changes, could have major impacts on ocean and coastal priorities.

One thing’s for sure, we’re in for a wild ride as these conversations plod on. Reach out to make sure your organization has a voice in this effort. To stay in the loop, sign up for our weekly policy report!